What African Banks and Fintechs Can Learn from Spotify, TikTok, Tinder, and Netflix.

If you use tiktok you get "addicted" but when you use netflix, it tells you what to watch next, Tinder is fun, you swipe left and right when it feels right, and Spotify just gets you.

Introduction.

In today's fast-moving digital world, some of the most successful apps—like Spotify, TikTok, Tinder, and Netflix—have mastered the art of attracting and keeping users. These companies have a lot to teach banks, mobile money providers, and fintechs in Africa about building products people love and use regularly. Here are some key lessons:

"When I walk into the bank to open another account and they ask me for my KYC again, I’m baffled—why? I already have an account here! This is just an additional savings account, something you should’ve predicted I’d need."

This frustration is not just personal; it reflects a bigger issue in how banks and fintechs are still operating. In an age where personalization and data are king, why should customers have to repeat themselves? Banks should be able to foresee needs, not force redundant processes. If a bank already knows me, why isn’t it simplifying my experience?

The following are areas I strongly believe banks could learn a thing or two from the super successful netflix, spotify, tiktok and tinder.

1. Personalization is Powerful

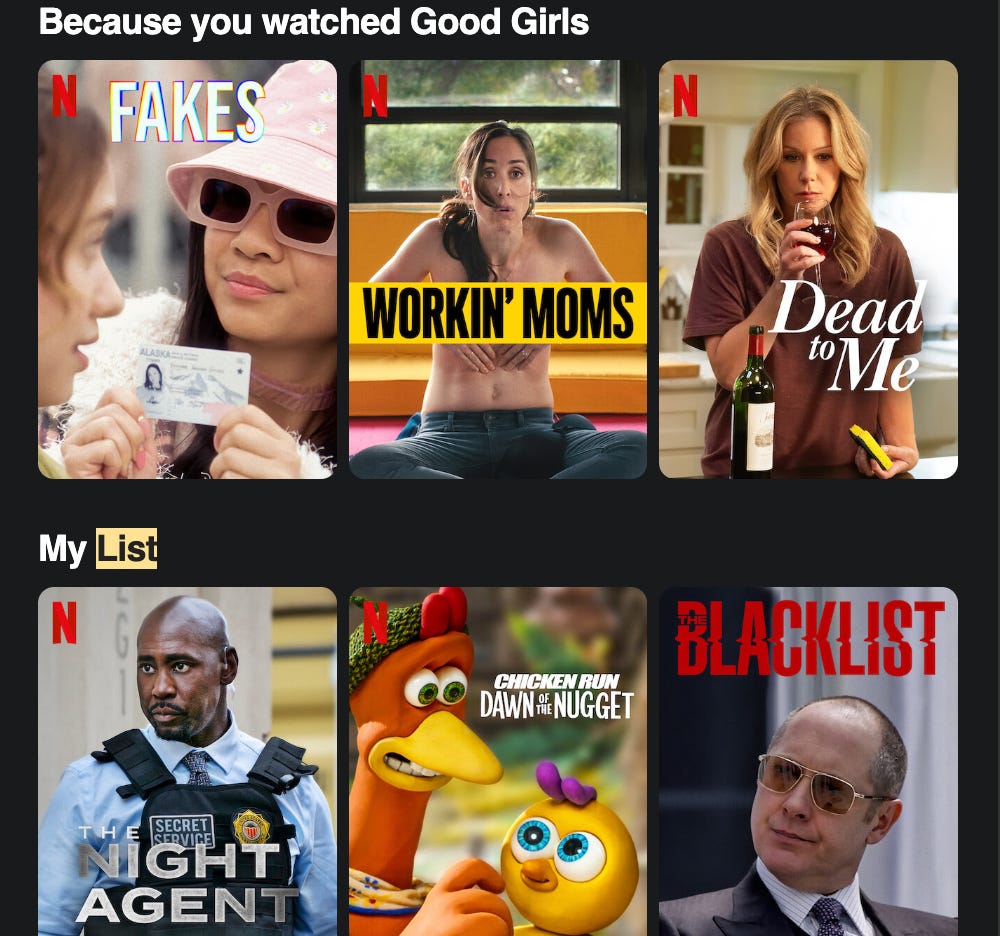

What Spotify and Netflix do: They use data to understand their users’ preferences. This helps them recommend the right songs or movies, keeping users hooked.

What banks and fintechs can do: Use customer data to offer personalized financial advice, savings options, or loan products. Predict and Propose, Imagine receiving a notification suggesting how much to save each month based on your spending habits.

2. Keep it Simple and Easy

What TikTok and Tinder do: Both apps are incredibly easy to use. You can start using them without needing any instructions because they focus on simplicity.

What banks and fintechs can do: Make your apps as simple as possible. Whether it’s opening a bank account, applying for a loan, or sending money through mobile money, the process should be quick and easy.

3. Make Banking Fun

What TikTok and Tinder do: They keep users entertained through social interactions, challenges, and viral trends. Users come back because it’s fun.

What banks and fintechs can do: You can make financial services more engaging by adding features that reward users for saving money or paying off loans. For example, you could give badges or rewards when users hit financial milestones.

4. Offer Flexible Subscription Models

What Spotify and Netflix do: They offer basic services for free and charge for premium features. This lets users try the service before committing.

What banks and fintechs can do: Consider offering free basic banking or mobile money services, with a subscription for premium features like higher transaction limits, priority customer service, or better interest rates. This gives customers the flexibility to upgrade only if they need more.

5. Innovate Regularly

What Netflix and TikTok do: They keep things fresh by continuously introducing new content and features, so users never get bored.

What banks and fintechs can do: Keep updating your app with new features that help people manage their money better. For example, offer new ways to track spending, set financial goals, or even access new products like insurance or small business loans directly from the app.

6. Think Global, Act Local

What Spotify and Netflix do: These global companies adapt their content to local markets, offering local songs and movies alongside global hits.

What banks and fintechs can do: When expanding to different African countries, tailor your products to local needs. Partner with local banks or mobile money operators to ensure your services fit local cultures and regulations. This approach will help build trust and adoption.

7. Make Payments Effortless

What Netflix and Spotify do: They make paying for subscriptions as easy as possible. Users can pay with one click and forget about it, thanks to auto-renewals and subscription.

What banks and fintechs can do: Think of “swipe right to approve the payment” or swipe left to reject it. Make your payment processes fast and simple. Whether customers are paying bills, sending money to family, or topping up mobile money, ensure the process is quick, engaging and frictionless.

8. Build an Ecosystem

What Netflix and Spotify do: Once users are inside their platforms, they find everything they need, whether it's a new song or TV show, keeping them from leaving.

What banks and fintechs can do: One bank has 5 apps for 1 customer—-that is confusion, Better Offer a full range of financial products in one app, from savings accounts to mobile money transfers, insurance, and loans. By providing multiple services in one place, you can keep customers engaged and loyal.

Final Thoughts: African banks, mobile money operators, and fintechs have a unique opportunity to learn from the world’s most successful digital platforms. By focusing on personalizations, simplicity, engagement, and innovation, they can build financial products that people love to use. Ultimately, the goal is to create seamless, enjoyable financial experiences that meet the diverse needs of customers across the continent.

"After using bank accounts and mobile money wallets for the last 15 years, I walk into a bank expecting more than just the basics. I expect them to know me, to understand that the services I needed 10 years ago are not the ones I need today. I’ve grown financially, and if banking was Spotify, my playlist would be different now—my tastes have evolved, and my priorities have shifted."

Understand My Growth: I expect the bank to recognize that my financial needs have changed. The tools and services that served me a decade ago don’t fit my current lifestyle. Whether it’s saving, investing, or managing multiple accounts, I need a different experience—one that fits where I am now.

Predict and Present Solutions: With the data banks have, they should anticipate my needs. If I’m moving funds frequently or making large transactions, they should offer me solutions before I ask. Like a streaming service curating recommendations, my bank should present tailored options, products, and offers that align with my current habits and financial goals.

Customized Offers: I want a personalized banking offer. I’m not a fan of high fees, but I love the convenience of digital spending, especially in a cash-rich economy. My bank should direct me to products that maximize my digital transactions while minimizing costs—crafted specifically for me based on how I spend, save, and invest.

It’s time for banks and fintechs to offer experiences that grow with us, understand our evolving needs, and use data to make smarter, more personalized offers. This isn’t just about customer service—it’s about keeping pace with our financial journeys.

Excellent article with simple down to earth advice for the traditional banks. I share your concern that despite having masses and masses of data about me they act as if they know very little about me. When applying for a mortgage from a bank where I have banked (and worked) for years they asked me more than once for my country of birth, date of birth, age next birthday, monthly income etc etc. They have such a long way to go and if greatest concern is that they change so very very slowly