Uber is not a tech company and Neither is Netflix. Tech founders must learn that first.

It is important to understand the underlying sectors you are in, That will influence who you hire, where you spend, potential revenues growth, and what is your valuation.

What is a tech company?

I must say this as we start, To be a great company, you don’t have to be a tech company, I mean some of the most impactful companies of our time are not tech companies themselves. Some of the companies you will see in this article are categorically not tech companies but that does not mean they are not great companies.

A tech company is typically a business that primarily focuses on developing and providing technological products or services. These companies often leverage technology as a core component of their business model, whether it's software development, hardware, or offering tech-enabled services. Examples of Tech companies includes LinkedIn, Google, Facebook, MSFT, SalesForce and WhatsApp.

Although today I want to focus on the opposite side, companies that are believed to be tech companies and sometimes valued like tech companies, funded and expected to grow like tech companies meanwhile they are actually not tech companies, They are what I call tech led companies. Examples include Apple, Uber, Amazon, Tesla and Netflix.

In most tech led companies, technology plays a significant role in their operations, the core offerings may still be rooted in traditional sectors, majority of their revenues, investment and expenditure are related to a traditional non tech product.

“The truth is some of the most impactful companies of our time are not tech companies themselves. Some of the companies you will see are not tech companies but that does not mean they are not great companies.”

Tech-led companies are indeed an intriguing phenomenon. These companies leverage technology extensively in their operations, marketing, and overall business model but fundamentally operate in traditional industries. Their strategic use of technology helps them achieve significant growth, secure higher valuations, and build strong brand identities similar to those of pure tech companies.

Tech led companies are companies innovating in a traditional industry and using tech to pose like a tech company, raise like a tech company, command valuations and build a brand around that effect.

I will use Netflix, Spotify, Tesla and Uber to elaborate why they are not tech companies, I will encourage you to use the same techniques to judge Tesla, Toyota, Apple, Citi, Purplebricks, RedFin, Bloomberg, The Washington Post, Spacex, VISA, AMEX, Samsung, Amazon, PayPal, SoftBank, M-pesa, AirtelMoney and Vodaphone.

Why is Netflix not a tech company?

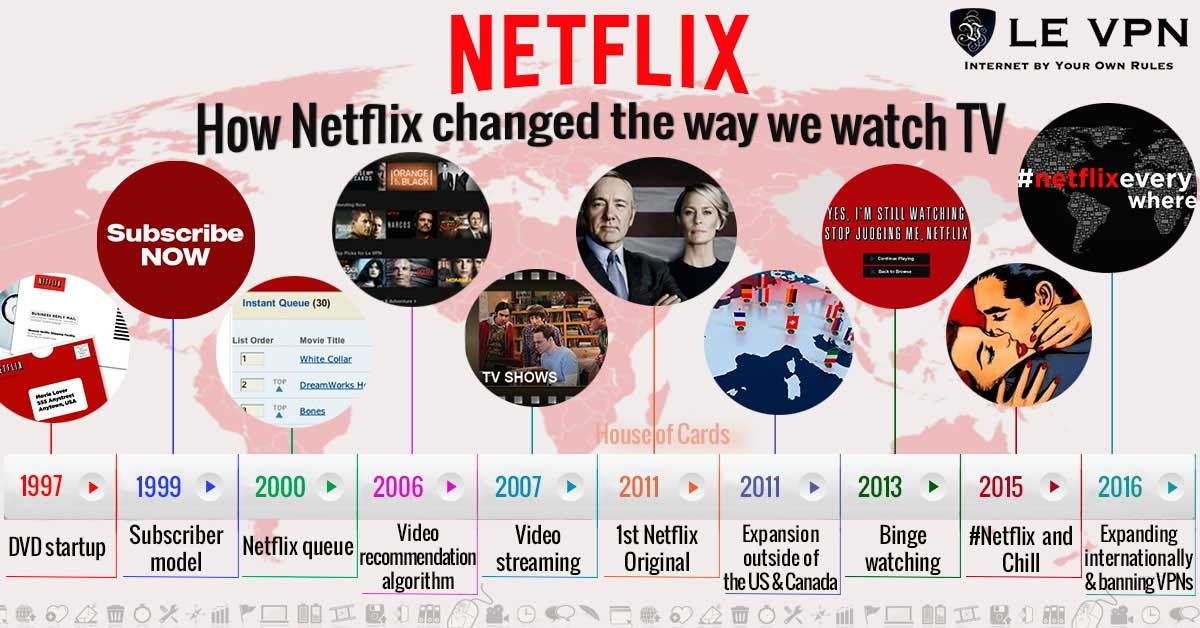

Netflix is not a tech company because its primary focus is on content creation and distribution rather than the development of technology itself. While technology is undoubtedly integral to Netflix's operations, its core business revolves around entertainment rather than technological innovation.

I agree with most pundits, that the technology has to be really good and so must the execution, but Netflix is still fundamentally a broadcasting business, and all of the questions that matter are broadcasting related questions not tech questions.

Netflix exemplifies a tech-led company by truly operating in the entertainment industry while transforming content delivery through innovative use of technology. By leveraging broadband internet, Netflix bypassed traditional distribution channels, providing direct access to consumers with a subscription-based model. This approach allowed Netflix to secure significant investment and command high valuations, akin to tech companies, due to its scalable growth potential and recurring revenue.

“Apart from WeWork, There’s a lot of companies that are believed to be tech companies and sometimes valued like tech companies, funded like tech companies and expected to grow like tech companies meanwhile they are actually not tech companies by any standard”

Netflix's strategy involves combining traditional entertainment skills with advanced technology for content delivery and user experience, supported by data analytics and cloud infrastructure. This integration enables efficient streaming, personalised recommendations, and a vast content library. The company's success highlights the importance of leveraging technology to innovate within traditional industries, setting realistic growth expectations, and aligning business strategies with market realities.

Why is Spotify simply a better music streaming company?

On the other hand, Spotify is considered a music streaming company because its main offering is a platform that allows users to stream music from a vast library of songs, Yeah, I know they also do podcasts and audio books. While technology is crucial to Spotify's operations, its core business model is centred around providing an audio streaming service to millions of users. If you study their financials and key challenges to their growth it has a lot to do with the music industry than technology.

Why is Uber not a tech company?, Because it’s a better transport marketplace!

Uber, despite heavily utilising technology for its ride-hailing platform, is often not classified as a tech company because its primary service is transportation rather than technological innovation. Like Netflix, Uber's core business revolves around providing a service (rides) facilitated by technology, and yes, they also deliver food and parcels. A great marketplace is where buyers meet sellers, a lot of them on both sides.

What about Tesla? Elon’s a genius, He is building a better car company.

If you read a lot you will find that Tesla is more like Toyota that it is like MSFT and is simply because they make cars and batteries, they make money and spend a lot on items related to the two. Tesla is becoming more of a car company every day, you know, builds and sells more cars. Plus, almost all revenue comes from its car business.

Honestly, Tesla should probably try to be more like Honda which does well in cars, bikes, batteries, generators and financial services, it also used to sell jet engines, solar panels even snowblowers. Here's why I say so: A few years ago, Tesla transitioned from being Tesla Motors to becoming a full-blown energy group. They’re not just about electric cars, they got into the solar-power, insurance and batteries too. On top of that, they've been pushing their energy storage business with their battery technology. But the market are still screaming that Tesla cant be a giant tech company but it is a Bigger better car company, Tesla is doing what Honda does by having a bunch of related businesses, which can really help with stability and long-term growth.

What about big tech? I tried to avoid this one!

Most bigtech are a collection of businesses and companies (conglomerates) so it is a little confusing to properly bucket any of them into a particular traditional industry, Example while Amazon is a giant e-commerce company (not tech), it is also a giant cloud computing company (Tech) and they are also an advertising company, This is the same for SamSung, Apple, Alphabet, Alibaba, MSFT, TenCent and even Meta.

Question: What are the underlying industries you are disrupting?

If You're a tech company, the underlying sectors will profoundly influence various aspects of your business: As a founder, investor or operator this is important.

Who You Hire:

The sectors you operate in will determine the skill sets and expertise you need in your team. For instance, if you're in AI and machine learning, you'll likely hire data scientists, AI engineers, and software developers.

Your hiring needs will evolve as technology and market demands change. For example, emerging sectors like quantum computing may require specialised expertise that's scarce in the current job market.

Your Customers:

Your target customers will depend on the sector you're operating in and the problem you're solving. For instance, if you're in fintech, your customers may include banks, financial institutions, or individual consumers.

Understanding your customers' pain points and needs within your sector will be crucial for developing products or services that resonate with them.

Your Key Partners:

Your key partners will include other companies or organizations that complement your offerings or help you reach your target market. For example, if you're developing a healthcare technology, your partners might include hospitals, research institutions, or medical device manufacturers.

Strategic partnerships can provide access to resources, expertise, and distribution channels that can accelerate your growth and market penetration.

The Market Size:

The market size varies significantly across different tech sectors. Some sectors may have vast global markets with high growth potential, while others may be more niche or limited in scope.

Understanding the market size and potential for growth within your sector is essential for strategic planning, resource allocation, and investment decisions.

Investments and Valuation:

Your sector's growth prospects, market size, and competitive landscape will influence investor interest and valuation.

Emerging sectors with high growth potential may attract more investment and command higher valuations, while mature sectors may face more scrutiny regarding sustainable growth and differentiation.

Investors will assess factors such as your technology's uniqueness, market traction, revenue potential, and scalability when valuing your company.

Conclusion:

The underlying sectors in which a tech company operates significantly shape its hiring strategy, target customers, key partnerships, market size, and investment opportunities, ultimately impacting its growth trajectory and valuation in the market.

Investors must distinguish between tech companies and tech-led companies to make informed decisions. This involves recognising the true nature of the business, evaluating it with appropriate metrics, and setting realistic expectations for growth and profitability. By doing so, investors can better manage their portfolios, mitigate risks, and align their investment strategies with their financial goals and risk tolerance.

For founders, distinguishing between tech companies and tech-led companies is critical for setting realistic goals, managing stakeholder expectations, and building sustainable businesses. By acknowledging the hybrid nature of tech-led companies, founders can better navigate the challenges and opportunities that arise from operating at the intersection of technology and traditional industries. This strategic awareness helps in crafting appropriate business strategies, securing suitable investment, and ultimately achieving long-term success.