Top 10 Fintech Friendly Banks in Tanzania, These banks embrace partnerships & collaborations with fintechs & neobanks.

With its market size, Tanzania is the best place to launch a new money app, neobank, insurtech or a fintech but you will need to partner with a bank that has done it before.

Introduction: In today's rapidly evolving financial landscape, partnerships between traditional banks and fintech companies are proving to be instrumental in driving innovation and expanding access to financial services. These collaborations enable banks to tap into the agility and innovation of fintech startups, while fintechs gain access to the established infrastructure and customer base of banks. Together, they are reshaping the way financial services are delivered, offering a wide array of solutions ranging from remittances to digital payments and beyond. In this context, evaluating the top banks for fintech partnerships becomes crucial, considering factors such as collaboration capabilities, technological readiness, and commercial terms.

What services: Bank partnerships encompass a wide array of services vital to modern financial ecosystems. These include facilitating remittances, powering FX-related apps, managing digital wallets, digital lending, credit scoring, processing digital payments, and establishing merchants aggregations. Furthermore, partnerships extend to card business operations, covering both issuing and acquiring services. Collaborating with banks proficient in these areas ensures comprehensive support for the diverse needs of consumers and businesses in today's dynamic financial landscape.

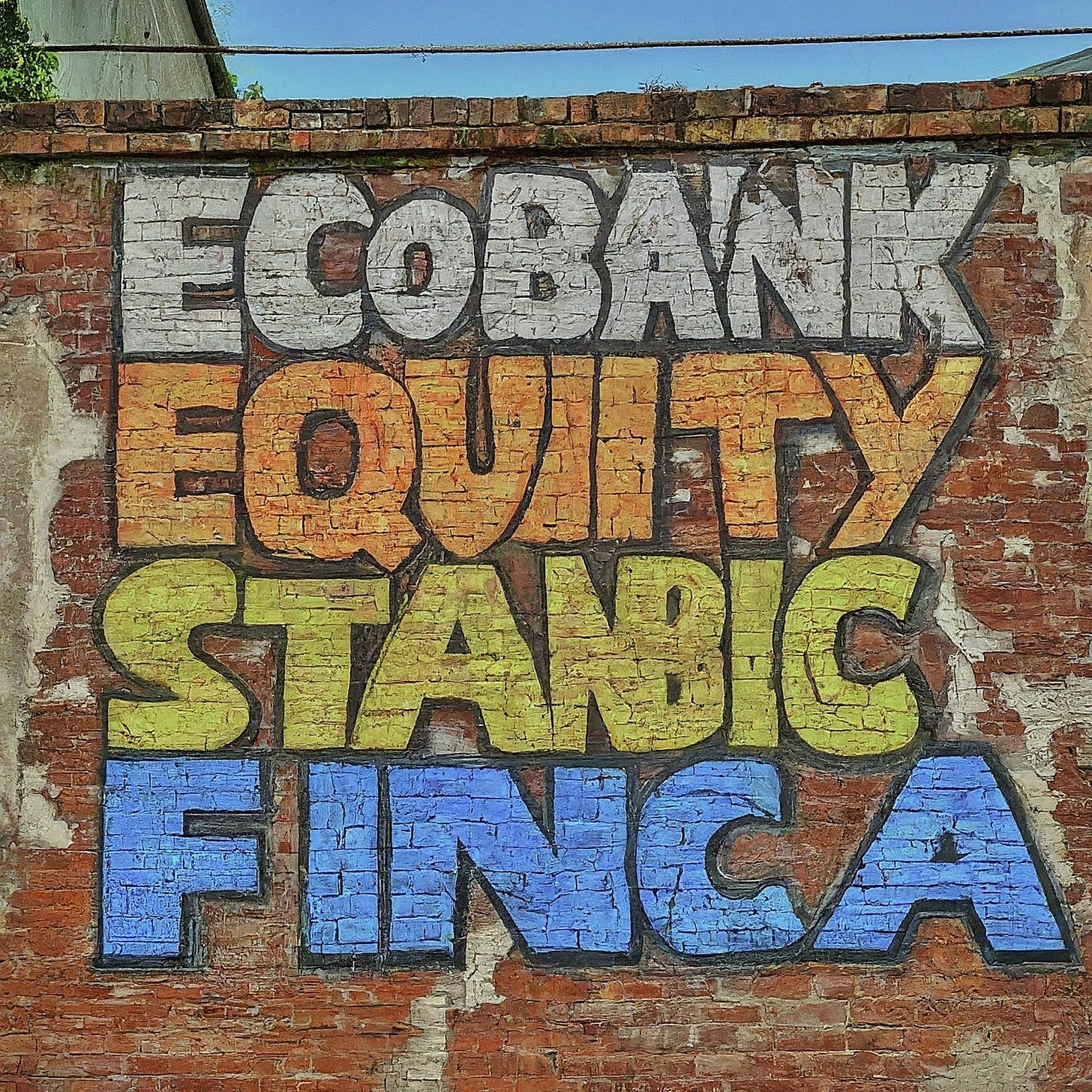

The top 10 banks embracing partnerships and collaborations with fintechs, startups and neobanks:

We assess potential partners based on several criteria. Firstly, we examine their capability and willingness to collaborate and innovate alongside fintechs and neobanks. Secondly, we scrutinise their technology readiness and resources. A partner with robust technological infrastructure and expertise is essential for seamless integration and efficient service delivery.

Lastly, we carefully consider the commercial terms they offer. A fair and advantageous commercial agreement is vital for ensuring a mutually beneficial partnership that fosters long-term growth and success.

Ecobank Tanzania: The pan African bank subsidiary is partnering with Laina focusing on alternative lending and insurance, Selcom which works with them on agency, billers and cards, Tembo which builds digital banking apps and APIs and Nala which works with the bank for remittances and FX services. Other partners includes Alipay, Western Union, Moneygram and RIA.

Equity Bank : The partnership between Equity and Nala for cross-border payments in Tanzania, later extending into Kenya. This collaboration served as a cornerstone in propelling Nala to the forefront of payment business. Leveraging Equity Bank's footprint to enter Kenya demonstrates how alliances between banks and fintech can transcend borders, driving financial inclusion across markets. Other partners with Equity includes WorldRemit, SmallWorld and RIA

KCB Bank: KCB Bank's collaboration with Sarafu, an innovative B2B e-commerce platform, alongside AzamPay a payment processor for digital loans and advances to retailers, reflects the bank's proactive approach to fostering fintech partnerships. This new product is not a personal loan, this is a business loan against the assets purchased by that business on the platform. Also, it is a shariah compliant product (industry first) so customers can feel comfortable using it.

Stanbic Bank: With Ramani as a partner Stanbic Bank Tanzania will participate in Ramani’s financial marketplace, providing strong capital to support working capital needs for key value chains that drive domestic trade in Tanzania.

TCB Bank: Tanzania Commercial Bank partnering with M-pesa and TigoPesa launching Mkoba and Kikoba shows how ready the bank is to push boundaries and work with fintech and credit scoring upstarts out there. The bank is also listed as a partner that works with Umoja switch as well as Cash Me Tanzania, another fintech.

Finca: Not only commercial banks are partnering with fintechs even the usually forgotten group of deposit taking microfinance banks, Leading that charge is, Finca, One of the oldest microfinance bank partnering with Kuunda and Mpesa to offer quick cash loans to majority of agents and subscribers in a credit card like limit on transactions is smart and has proved to be so big in terms of revenues for the parties to even strengthen their collaboration.

Other banks like ABSA Bank, CRDB Bank, DTB Bank, and NMB bank have emerged as followers in forging partnerships with leading fintech companies such as Jumo, Selcom, Credable, Mpesa, and TigoPesa. This collaborative effort signifies a profound shift in the banking landscape, where traditional financial institutions are embracing technological advancements to offer innovative solutions to their customers. This strategic alliance approach not only fosters competition but also fosters a conducive environment for financial innovation, ultimately benefiting consumers across Tanzania by providing them with access to a broader range of convenient and efficient financial services.

In conclusion, Unlike these partnerships with mobile money operators, Bank partnerships with fintech companies represent a truly pivotal force driving innovation and financial inclusion. These collaborations leverage the strengths of both parties to deliver innovative solutions and services that meet the evolving needs of consumers and businesses. By evaluating potential partners based on collaboration capabilities, technology readiness, and commercial terms, banks can forge strategic alliances that drive mutual growth and success in the dynamic fintech landscape. As demonstrated by the notable partnerships highlighted, the future of banking lies in collaboration and innovation.